Navigating Kenya’s tax system may be challenging, specially when you receive a KRA Detect of Evaluation. This official doc through the Kenya Revenue Authority (KRA) normally leaves numerous taxpayers puzzled and uncertain with regards to their future techniques. Regardless of whether you’re a person, SME, or large corporation, knowledge the KRA Detect of Evaluation is important for remaining compliant and steering clear of avoidable penalties. At Gichuri & Partners, we specialize in aiding clients sound right of these notices and react strategically.

A KRA Notice of Assessment is basically a formal declaration by KRA indicating the amount of tax you owe. This may be based on a discrepancy in filed returns, late submissions, or undeclared money. It may result from automatic techniques or maybe a specific audit. The notice outlines the tax sum thanks, such as penalties and desire, and gives a timeline within just which the taxpayer need to respond. Lots of people mistakenly presume the recognize is ultimate, but it really’s crucial to know that you have the right to obstacle or attractiveness it.

Gichuri & Partners has addressed numerous these assessments. Our experience reveals that well timed and informed responses typically bring about favorable results. The 1st and many crucial stage is understanding why the KRA See of Evaluation was issued. At times, the KRA could have relied on incomplete details, or there may well have already been problems in how returns were being filed. An in depth evaluation by tax specialists can reveal whether or not the assessment is exact or could be lawfully contested.

Responding effectively into a KRA Detect of Assessment is critical. You usually have thirty times to either settle for the evaluation and spend the tax or file an objection. This objection must be properly-documented, presenting legitimate grounds including factual inaccuracies, misapplication of tax law, or reliance on incorrect figures. At Gichuri & Associates, we aid purchasers compile and post these objections skillfully, escalating the likelihood of achievement.

It is vital to note that ignoring a KRA See of Evaluation doesn't ensure it is go away. In case you fall short to act, the evaluation turns into closing, plus the KRA can initiate enforcement steps which include asset seizures or bank account freezes. These consequences could be critical and disruptive, notably for businesses. Our workforce makes certain you hardly ever pass up a deadline and generally just take the right lawful steps to safeguard your passions.

In some instances, a KRA Discover of Assessment might appear following a tax audit. They're more in depth evaluations wherever KRA officers review your money statements, lender transactions, and supporting files. If difficulties occur from these kinds of audits, the see will outline the findings and changes. Gichuri & Companions advises purchasers through audits to be sure correct documentation and conversation, minimizing the potential risk of an unfavorable evaluation.

Among the list of frequent misconceptions is always that only companies get a KRA Discover of Evaluation. Having said that, individual taxpayers may also be topic to scrutiny. Should you have multiple income sources, rental properties, or overseas profits, the likelihood of triggering an assessment improve. Our consultants supply personalized tax intending to minimize these pitfalls and ensure your declarations align with KRA necessities.

At times, accepting the KRA See of Assessment and arranging a payment system is easily the most sensible possibility. We function with KRA to barter installment payment options that happen to be manageable for our customers. This technique avoids authorized escalation and maintains your tax compliance standing. Nevertheless, any agreement has to be formally documented to prevent misunderstandings Sooner or later.

At Gichuri & Partners, we also present post-evaluation advisory. When your situation is solved, we assist you apply internal controls, revise accounting techniques, and increase documentation standards in order to avoid foreseeable future assessments. The aim is not just resolution, but prolonged-phrase tax overall health.

In conclusion, the KRA Recognize of Evaluation is not one thing to fear, nonetheless it does need notice, knowledge, and Experienced managing. Whether or not you should dispute the figures, negotiate with KRA, or perhaps have to have direction on exactly what the detect means, Gichuri & Associates is listed here that will help. With above 20 years of knowledge in tax technique and compliance, we tend to be the trustworthy ally for people and corporations navigating Kenya’s elaborate tax from this source atmosphere. Don’t Permit a KRA Notice of Evaluation capture you off guard—access out these days and let's make it easier to take care of it with self confidence.

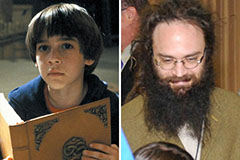

Barret Oliver Then & Now!

Barret Oliver Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!